Bitcoin Savings

Returning to the Simple Essence of Private Key Management

The storage of Bitcoin private keys is the most critical element in the entire cryptocurrency ecosystem. Over the past decade, countless investors have lost their digital assets due to improper private key management. This article will explore a well-thought-out Bitcoin private key storage solution designed for long-term savings. This solution is built on a comprehensive analysis of various threat models and takes into full consideration human weaknesses and real-world limitations.

Before discussing specific solutions, we need to clarify a key concept: Bitcoin private key storage is not just a technical problem, but a comprehensive challenge involving human nature, security, and usability. Any solution claiming to be "perfect" should be viewed with skepticism, as it often ignores the complexities of the real world. The solution proposed in this article is built on a deep understanding of human weaknesses while also considering the specific needs of different user groups.

Method

Simplicity is the ultimate sophistication.

Many people advocate engraving mnemonic words on stainless steel, titanium alloy, or other metal materials, believing this provides protection against water and fire. However, this method has serious security risks: text on metal materials is clearly visible under X-ray scanning. This means that anyone could potentially see your mnemonic words through security equipment when crossing borders. In comparison, writing mnemonic words on pages of a personal book is a safer choice - text on paper is almost unreadable under X-ray, and this method doesn't attract special attention. Once you reach your destination, you can easily recover your funds using any BIP39-compliant hardware wallet. Based on these considerations, this article proposes a simple yet reliable solution: dividing the Bitcoin private key into two independent parts - mnemonic words and passphrase, using different storage strategies for each. Specifically:

Paper can last for over 1,000 years. If you're concerned about water damage and fire, you can write multiple copies in different books. These can be kept in your home bookshelf, library, or relatives' homes. The advantage of books as storage media is that they are designed for long-term preservation, and under ideal conditions (avoiding direct sunlight, controlling temperature and humidity, preventing insect damage), paper can easily last over a thousand years. This is proven by the existence of ancient books that survive to this day. The mnemonic words use the most traditional pen and paper recording method, using ordinary paper and ink pen. This seemingly primitive method is actually the most reliable - under proper preservation conditions, paper records can last for thousands of years. The passphrase, on the other hand, relies entirely on brain memory, and this separation ensures that funds remain secure even if the mnemonic words are compromised.

Writing Media & Fire‑Resistant Strategy:

If you need your mnemonic to survive flooding, alcohol scrubbing, and an 800 – 1000 °C house fire,

always write with pigment‑based, weather‑proof pens:

water‑proof paint markers,

laboratory alcohol‑resistant fine‑tip pens (e.g. Staedtler Lumocolor 319),

or 1000 °C‑rated high‑temperature paint markers (Okitsumo HT / Markal HT / Yanweiban 1000 °C).

Their inorganic pigments, once dry or cured, withstand repeated immersion,

75 % ethanol wipes, and brief extreme‑heat shocks, preventing the fading or carbonisation that ruins ordinary dye inks.

After writing, lay the sheet or notebook flat inside a readily available

fire‑proof document bag—typically a double‑layer fiberglass + aluminium‑foil laminate

(UL‑94 / EN 1363 rated 30 min at 1093 °C).

Place the mnemonic sheet at the deepest part of the foil pouch and add a few blank A4 pages on the outer side as extra insulation.

Stick a clear label on the outside (“Important documents inside—do not open casually”) to discourage idle browsing

and to guide heirs in emergencies.

Redundancy plan: prepare 2 – 3 identical fire‑proof bag copies and store them separately

in your home bookshelf, a remote location, and another secure address.

If one site is lost, the others remain. Inspect each bag and check legibility every 12 months to ensure long‑term readability.

| Origin | Brand / Model | Rated Limit | Recommended Substrate | Keywords / Typical Channel |

|---|---|---|---|---|

| Japan | Okitsumo Heat‑Resistant Marker (white / yellow) | 1000 °C | Stainless steel, titanium | “Okitsumo heat marker 1000C” Amazon JP, Monotaro |

| China | Yanweiban 1000 °C Paint Marker | 1000 °C | Stainless steel, titanium, sand‑blasted aluminium | “Yanweiban high‑temperature marker 1000°C” JD.com, Taobao |

| China | Filolang MK‑100 (fine tip) | 800 °C | Stainless steel, titanium, stone paper | “Filolang MK‑100 800°C” 1688, JD.com |

| Japan | Sakura Solid Marker | 482 °C | Ceramic tile, mica paper, stone paper | “Sakura solid marker high temperature” Amazon, Rakuten |

| Japan | TOYO SA101 Paint Pen | ≈ 500 °C | Stainless steel, aluminium (scuff first) | “Toyo SA101 heat‑resistant marker” JD.com, Taobao |

| China | Yatong LM‑721 Paint Marker | 600 °C | Stainless steel, ceramic | “Yatong LM721 high‑temperature marker” Taobao, industrial supplies |

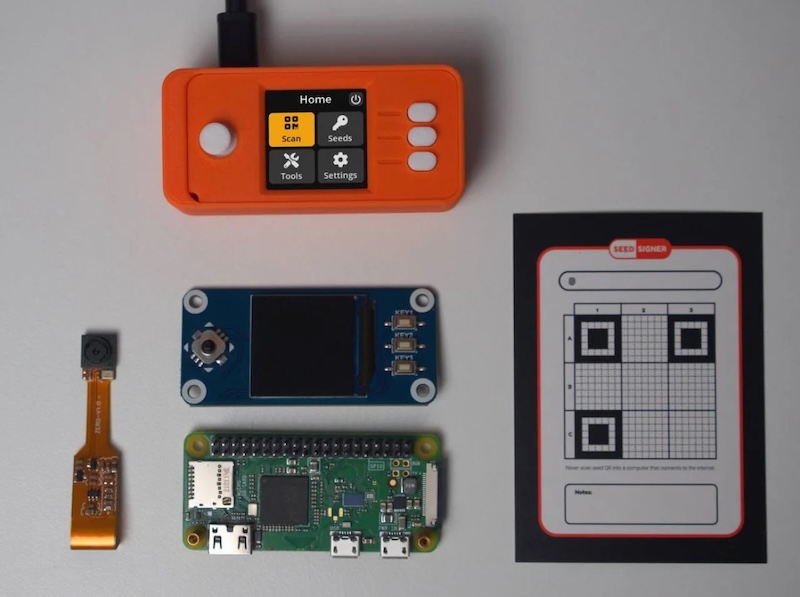

At the implementation level, our recommendations are clear: For large Bitcoin savings, we recommend using Seed Signer as the signing device, paired with Sparrow wallet software. This combination achieves true air gap isolation and is completely open-source and verifiable. Remember, Seed Signer never stores any keys, requiring re-entry each time it's used - this is actually its design advantage.

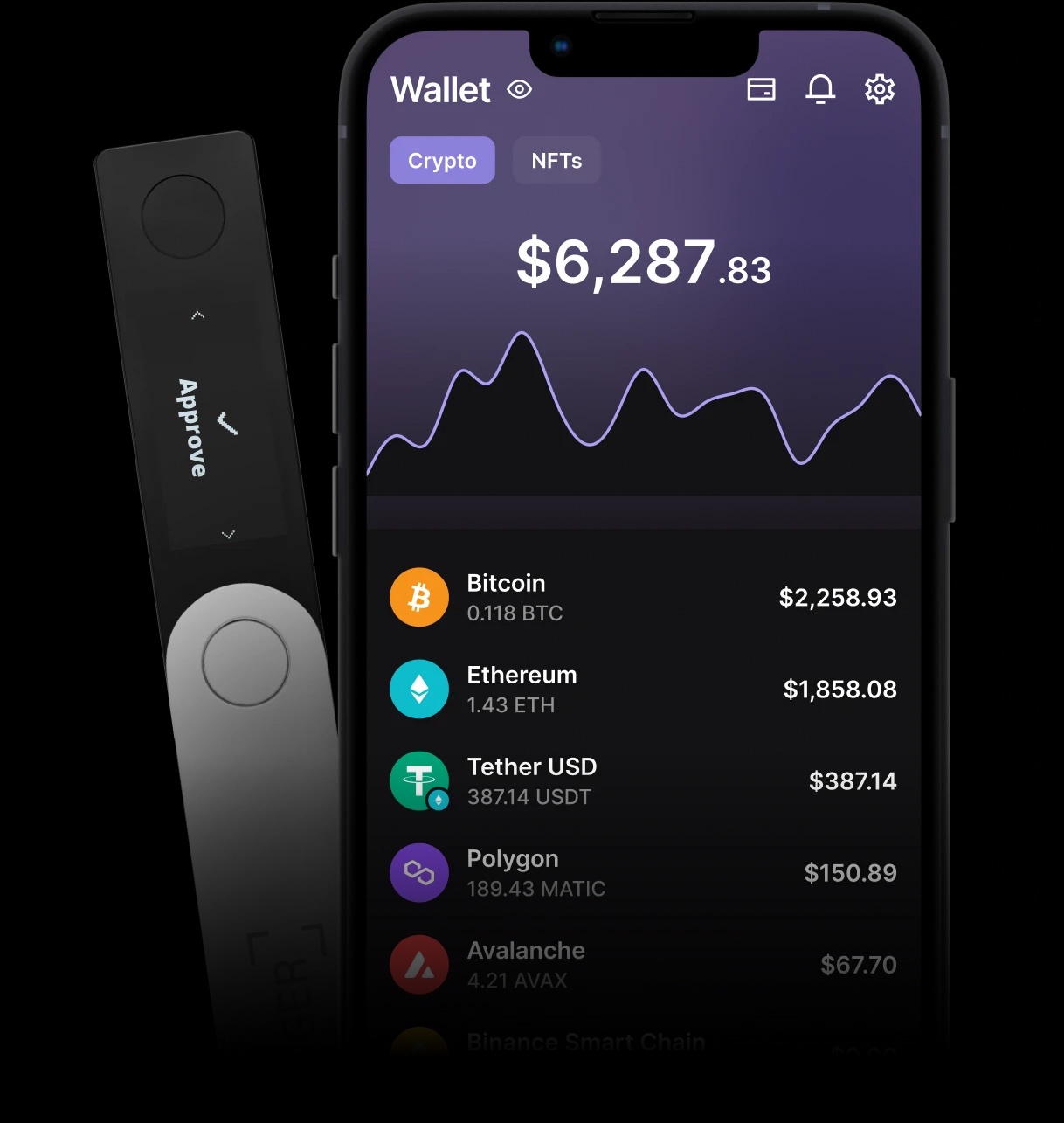

Hardware choice considerations: Seed Signer, being completely open-source hardware, is ideal for long-term Bitcoin savings; while Ledger, with its broad ecosystem support, is more suitable for altcoin management. Both should use self-generated seeds for import rather than the device's built-in random number generator. This combination ensures absolute security for core assets while maintaining convenience. For managing other cryptocurrencies (altcoins), you can choose a Ledger hardware wallet, used with various Chrome browser plugins that support Ledger. Ledger's excellent ecosystem support ensures convenience in DeFi and other scenarios. However, remember that the passphrase in Ledger devices should only be entered temporarily, not stored permanently.

Regardless of which device you choose, one principle remains constant: always use self-generated seeds to import into devices, rather than blindly trusting the device's random number generator. This isn't about distrusting device manufacturers, but rather faithfully practicing the "Don't trust, verify" principle.

Air gap (physical isolation) is an extreme security measure where devices maintain physical isolation from the internet and other devices with network capabilities. This term originally comes from military and industrial control fields, such as critical systems in nuclear power plants that use air gap isolation. In the Bitcoin realm, air gap devices typically use QR codes, microSD cards, or handwritten data for physical information transfer, eliminating the possibility of remote attacks at the hardware level. For Bitcoin minimalists who adhere to the "Don't trust, verify" principle, devices like Seed Signer provide a path to building a completely verifiable system starting from the hardware level. These devices achieve complete air gap isolation, transmitting seed information through hand-drawn QR codes. While this method may seem cumbersome, it provides users with a completely transparent and controllable signing environment.

While the solution described above might seem simple, each technical choice contains profound considerations. To better understand this solution, we need to start from the most basic concepts and deeply analyze the principles and significance of each technical component. Let's first look at the origin of the Mnemonic Words concept.

Mnemonic Words: Making Random Numbers Memorable

Technology is best when it brings people together.

A Bitcoin private key is essentially a 256-bit random number. While this is perfect for computers, it's like hieroglyphics to human cognitive systems. During evolution, the human brain developed specific memory patterns - we excel at remembering concrete objects and emotional experiences, not abstract number sequences. This cognitive gap led to the creation of BIP39.

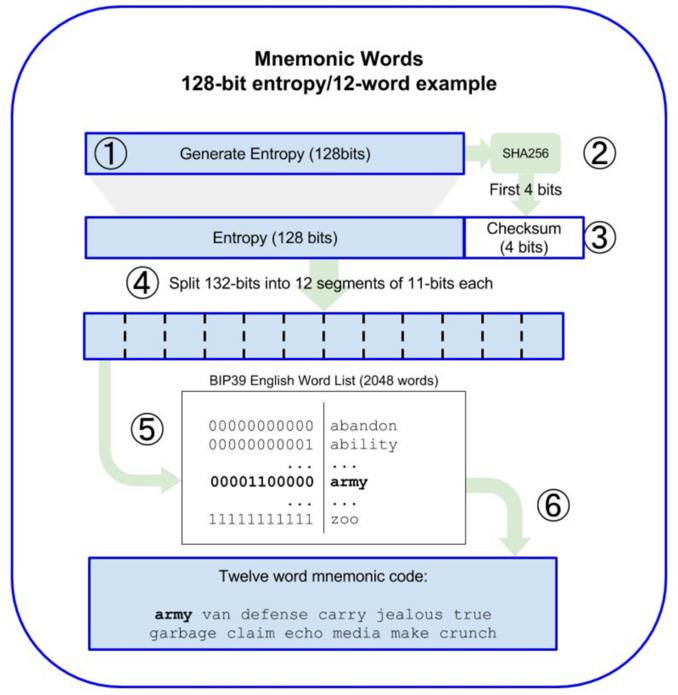

BIP39, which stands for Bitcoin Improvement Proposal 39, was introduced in 2013 and marks a significant milestone in Bitcoin's history. Through a carefully designed algorithm, it maps 256-bit random numbers to a library of 2048 carefully selected English words, ultimately converting them into groups of 12 or 24 words. This conversion maintains the original cryptographic security while greatly improving human memorability and writability.

The mnemonic word generation process defined by the BIP39 specification.

Words come from the BIP39 standard wordlist, carefully selected:

each differs by at least 4 letters, avoids similar words, and can be uniquely identified by first 4 letters. For detailed implementation,

refer to Ian Coleman's BIP39 tool.

BIP39's core innovation lies in its clever balance between computer randomness and human memorability. As shown in the side diagram, the process converts pure random numbers into mnemonic words through SHA256 and lookup tables, maintaining cryptographic security while greatly improving usability. Each mnemonic word represents 11 bits of entropy, and with the final checksum, forms a complete cryptographic system.

The mnemonic word generation process defined by the BIP39 specification.

Words come from the BIP39 standard wordlist, carefully selected:

each differs by at least 4 letters, avoids similar words, and can be uniquely identified by first 4 letters. For detailed implementation,

refer to Ian Coleman's BIP39 tool.

BIP39's core innovation lies in its clever balance between computer randomness and human memorability. As shown in the side diagram, the process converts pure random numbers into mnemonic words through SHA256 and lookup tables, maintaining cryptographic security while greatly improving usability. Each mnemonic word represents 11 bits of entropy, and with the final checksum, forms a complete cryptographic system.

Each word in the wordlist represents 11 bits of information (2^11=2048), which explains why we need 24 words to securely store a 256-bit key (24 × 11 = 264 bits, with some used for checksum). This design ensures cryptographic security while accommodating human cognitive limitations as much as possible.

However, even a combination of 12 random words remains a significant memory burden for most people. These words have no semantic connection and don't form any meaningful narrative. Memorizing them is like memorizing a string of unrelated phone numbers, which goes against natural human memory patterns.

The solution to this problem comes from the concept of passphrase. It allows users to add a custom "25th word" to the mnemonic words. Unlike randomly generated mnemonic words, this passphrase can be any user-chosen string, providing possibilities for personalization and memorability.

The passphrase combines with the mnemonic words through the PBKDF2-HMAC-SHA512 function to generate the final seed. This means that even with the same mnemonic words, different passphrases will generate completely different wallets. This design cleverly implements "two-factor" protection: mnemonic words as "something you have," and passphrase as "something you know." This separation not only provides an additional security layer but also forms the foundation for designing a complete Bitcoin savings solution.

Warning! Is Your Mnemonic Really Random?

God does not play dice with the universe, but when we need randomness, we should make sure we roll the dice ourselves.

In the Bitcoin world, there's a fundamental security issue that's often overlooked: where exactly does your private key come from? Even with the most secure hardware wallet, if its random number generator has been tampered with, all security measures become meaningless. This threat isn't just theoretical - there have been multiple cases in history where random number generators were found to contain backdoors.

Imagine this scenario: a hardware wallet manufacturer implements a special random number generation algorithm in their devices. On the surface, the numbers appear completely random, but in reality, all generated private keys come from a predetermined range. It's like a safe with millions of keys - seemingly secure, but the manufacturer might hold a master key.

Early dice generation methods attempted to generate BIP39 mnemonic words directly using ordinary dice. While mathematically correct, this method had serious practical issues: first, it required many rolls (about 5 per word), making it time-consuming and error-prone; second, users often resorted to online tools or programs to simplify the process, violating the air gap principle. Most importantly, the online tools themselves could contain malicious code, introducing new security vulnerabilities. This is why better solutions were later developed. Based on these security concerns, the Bitcoin community developed various physical random number generation methods. The earliest attempts used regular dice, but while theoretically viable, this method proved too complex and error-prone in practice. The community needed a solution that was both secure and practical.

Entropia V2 "Austrian Edition" provides an elegant solution. This physical random number generation toolkit includes

the complete BIP39 wordlist and generates mnemonic words through physical extraction. Each dice is printed with

words from the wordlist, and users can build mnemonic phrases through multiple random draws. This method is not

only completely verifiable but also adds a ceremonial aspect to the private key generation process.

In this context, professional physical random number generation tools emerged. OpenPills provides such an open-source 3D printing solution. The core philosophy of these tools is to generate random numbers through visible, touchable, and verifiable physical processes, rather than blindly trusting electronic devices' random number generators.

Entropia V2 "Austrian Edition" provides an elegant solution. This physical random number generation toolkit includes

the complete BIP39 wordlist and generates mnemonic words through physical extraction. Each dice is printed with

words from the wordlist, and users can build mnemonic phrases through multiple random draws. This method is not

only completely verifiable but also adds a ceremonial aspect to the private key generation process.

In this context, professional physical random number generation tools emerged. OpenPills provides such an open-source 3D printing solution. The core philosophy of these tools is to generate random numbers through visible, touchable, and verifiable physical processes, rather than blindly trusting electronic devices' random number generators.

In practical terms, you do not need to spend hundreds of dollars 3‑D‑printing an “orange pill” entropy kit. The most economical approach is to use any ordinary laser printer with a resolution of ≥ 300 DPI to print the full 2,048‑word BIP‑39 word‑list onto a few sheets of A4. Cut the sheets into strips (or laminate them), then use a Japanese “Kokkuri‑san” pen‑spirit game—or simply toss dice to pick rows and columns—to select 23 random words. The 24th checksum word can be calculated offline with a Seed Signer running in air‑gapped mode, never touching a network. This yields a fully auditable mnemonic set that is virtually equivalent in security to far more expensive physical solutions.

Physical methods of generating random numbers might seem "primitive" or "not high-tech enough," but this is precisely their advantage. These methods completely eliminate dependence on hardware manufacturer trust, implementing one of Bitcoin's core principles: "Don't trust, verify."

More importantly, the physical random number generation process has an unexpected benefit: it forces users to slow down and carefully consider each step of private key generation. This deliberately slowed process not only reduces operational errors but also helps users better understand the essence of Bitcoin private keys - they are just random numbers, and the quality of these random numbers directly determines your asset security.

Therefore, for users planning to hold Bitcoin long-term, carefully considering the source of private keys isn't optional - it's essential. Whatever physical random number generation method you choose, the important thing is to ensure the process is completely understandable and verifiable to you. After all, in the cryptocurrency world, your private key is your sovereignty, and this sovereignty shouldn't be built on trust in any third party.

BIP39 Wordlist: 2048 Carefully Selected Words

The 2048 English words used in BIP39 were not randomly chosen but carefully selected. These words are relatively simple and common, and deliberately avoid easily confused similar words. For reference and use, here is the complete BIP39 wordlist:

It's a good practice to print out this wordlist and keep it safely stored. It can help you verify mnemonic words in an offline environment and can also be used for manual mnemonic word generation. Note that verifying mnemonic words online may pose security risks, so it's recommended to use offline tools or hardware wallets for handling mnemonic words.

Passphrase: The Digital Art of Misdirection

Deception in service of the greater good is not a fault—it is a feature.

The Shell Game, an ancient practice dating back to medieval Europe, demonstrates the art of protective deception:

a skilled operator presents multiple shells, with only one hiding the true prize. This centuries-old practice

inspired modern security concepts of "plausible deniability" - creating believable decoys to protect the real value.

This parallels Bitcoin's passphrase mechanism, where multiple valid wallets can exist, each appearing equally legitimate.

In cryptography, there exists the famous "rubber-hose attack" or "$5 wrench attack" dilemma: even the most complex encryption algorithms can't resist simple physical threats. Facing this challenge, Bitcoin provides an elegant solution through its passphrase mechanism, a design that could be considered the digital equivalent of the ancient Shell Game.

The passphrase serves as a "salt" in cryptographic terms, but its role extends far beyond traditional salting. Each different passphrase leads to a completely different key derivation path: Master Key = HMAC-SHA512(Key="Bitcoin seed", Data=Seed) where Seed = PBKDF2(Password=Mnemonic || Passphrase, Salt="mnemonic"+Passphrase) While a passphrase might look like a regular password, its mechanism is entirely different. Regular passwords are used for identity verification - enter the correct password, and you unlock specific content. However, a passphrase actually extends the mnemonic words, combining with them through the PBKDF2-HMAC-SHA512 function to generate an entirely new seed. This means each different passphrase generates a completely different wallet, rather than simply "locking" the same wallet.

Technically, the final seed generation process can be represented as:

Seed = PBKDF2(

Password = mnemonic_words || passphrase,

Salt = "mnemonic" + passphrase,

Iterations = 2048,

OutputLength = 512 bits

)

This design provides two crucial security features: First, there's no such thing as an "incorrect passphrase" - every passphrase generates a valid wallet, eliminating the possibility of brute-force detection. Second, even if the mnemonic words are compromised, funds remain inaccessible without the correct passphrase, providing an additional security layer. From a mathematical perspective, if an attacker obtains the mnemonic words, attempting to brute-force an 8-character passphrase containing uppercase and lowercase letters, numbers, and special characters would require trying (26 + 26 + 10 + 32)^8 ≈ 2.8 × 10^14 possibilities.

Based on this unique design, the passphrase not only provides additional security but also offers a viable defense strategy against physical threats: you can prepare multiple passphrases, each corresponding to wallets with different amounts. When faced with threats, you can reveal the passphrase for a smaller wallet as a decoy, both protecting your main assets and providing a plausible appearance of compliance. The key to this strategy is that all wallets are "real" - no one can prove you have other passphrases.

A passphrase can be any string, not limited to English words. This means you can use phrases that have special meaning to you, like a fragment of a poem or a life detail only you know the background of. This personalization not only enhances security but also greatly improves memorability. After all, human memory excels at storing meaningful information rather than random character combinations.

However, this powerful defense mechanism comes with a severe challenge: if you forget the passphrase, it means permanent loss of access to the corresponding wallet's funds. Unlike centralized services' "password recovery" function, in the Bitcoin network, there is no way to recover a lost passphrase. This requires us to carefully balance defensive capabilities with memorability when choosing a passphrase. Choosing a passphrase that is both secure and unforgettable might be the most carefully weighted decision in Bitcoin storage security.

In June 2021, early Bitcoin participant Mircea Popescu died accidentally in Costa Rica, reportedly controlling up to 1 million bitcoins.

This tragic event reminds us that in the cryptocurrency world, key inheritance planning is as important as asset security.

Without proper inheritance plans, massive assets might be permanently locked on the blockchain, becoming "lost coins."

The Bitcoin community has witnessed too many cases of bitcoins being permanently locked due to lost keys or sudden accidents. This reminds us that a complete Bitcoin storage solution must consider not only security but also how to ensure assets can be retrieved by legitimate heirs in extreme circumstances. This requires designing a reasonable key inheritance mechanism while maintaining security.

In June 2021, early Bitcoin participant Mircea Popescu died accidentally in Costa Rica, reportedly controlling up to 1 million bitcoins.

This tragic event reminds us that in the cryptocurrency world, key inheritance planning is as important as asset security.

Without proper inheritance plans, massive assets might be permanently locked on the blockchain, becoming "lost coins."

The Bitcoin community has witnessed too many cases of bitcoins being permanently locked due to lost keys or sudden accidents. This reminds us that a complete Bitcoin storage solution must consider not only security but also how to ensure assets can be retrieved by legitimate heirs in extreme circumstances. This requires designing a reasonable key inheritance mechanism while maintaining security.

Passphrase Security: An Infinite Universe of Wallets

This is a real Reddit security challenge, demonstrating how difficult it is to crack a passphrase even with the mnemonic words and numerous hints. The eventual cracking process proved the limitations of brute force attacks. The passphrase is BIP39's most powerful yet often overlooked security feature. It's not just an additional password, but a magical key that can create infinite possibilities. Each different passphrase generates a completely new wallet from the same set of mnemonic words, creating an astonishing space of possibilities.

Let's look at a real case that occurred on Reddit: someone published a wallet's mnemonic words containing 0.0002437 BTC:

symptom few lift suspect hire visual oppose sustain merge drastic salmon requireThe challenger informed everyone that this wallet had a passphrase set and gradually provided the following clues:

- The passphrase is 20 characters long

- Contains special characters $ and !

- Contains letters y, g, r, and n

- Uses a total of 11 different letters

Even with this much information, very few people could crack the password over several months. The final password was proven to be "y0ulln3v3rgue$$thi$!". This process perfectly demonstrates the power of passphrases: even knowing it's 20 characters long, considering just lowercase letters, numbers, and two special symbols, the possibility space reaches (26+10+2)^20 - an astronomical number. In real usage, our passphrases can use any characters with unlimited length, creating a security barrier that's practically impossible to brute force.

Most importantly, a good passphrase doesn't need to be as complex as the example above. It can be a phrase that has special meaning to you, a unique life detail that only you know, or a distinctive memory. This personalization not only ensures security but greatly enhances memorability.

Just considering combinations of 11 English letters: 26^11 ≈ 3.67×10^15 possibilities. That's 36.7 trillion, or 0.367 quadrillion. To understand this scale: the Milky Way has about 100-400 billion stars, and this password space is tens of thousands of times larger than the galaxy's maximum star count. In other words, if you multiply the number of stars in the Milky Way (assume 200 billion) by over 10,000, you'd approach the scale of this total password count. Detailed calculation: 26^2=676, 26^3=17,576, 26^4=456,976, 26^5=11,881,376, finally 26^11≈3.67×10^15. When we discuss password complexity, even considering the simplest case - combinations of 11 lowercase English letters, the number of possibilities is astronomical. In practical use, since we can use uppercase letters, numbers, and special symbols, with no length restriction, the actual possibility space far exceeds this number. This is why a carefully designed passphrase is effectively impossible to crack through brute force.

Bitcoin Wallet Software Selection

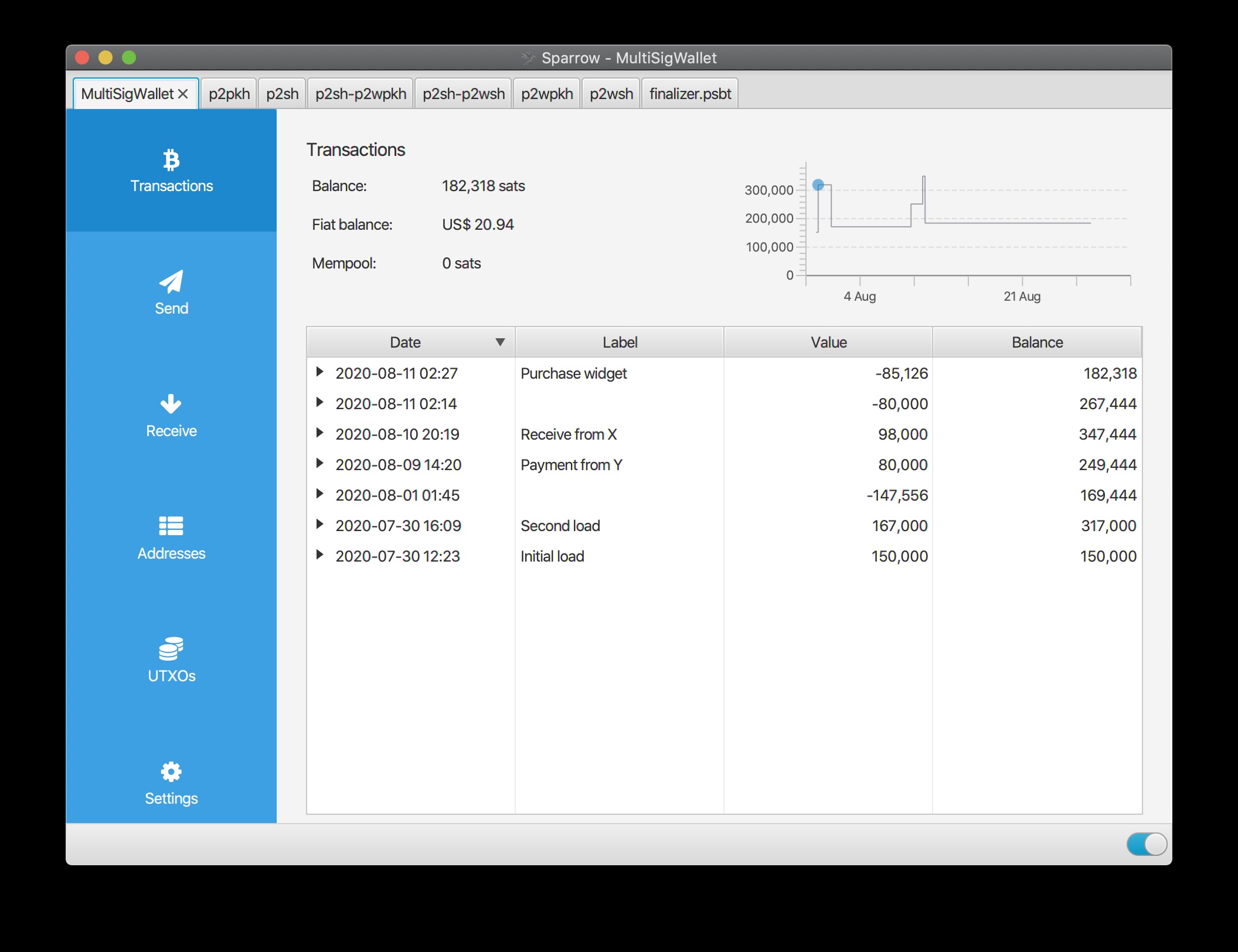

Before discussing hardware wallets, we need to first understand a key software tool: Sparrow. This open-source Bitcoin wallet software not only serves as a unified interface for various hardware wallets but is also crucial support for implementing advanced security strategies.

To help users better understand Sparrow's functionality, here's a detailed tutorial:

This video demonstrates Sparrow's main features, from basic setup to advanced functionality usage. As an open-source Bitcoin wallet software, every feature of Sparrow is transparent and verifiable, which is crucial for building a trustworthy Bitcoin storage solution.

Sparrow's interface design reflects its core philosophy: supporting advanced features while maintaining intuitive usability.

From multisignature to watch-only wallets, from single private keys to complete HD wallets, all these complex concepts

are integrated into a unified interface.

Compared to other wallet software, Sparrow has two notable security features: First, it uses Argon2 (the 2015 Password Hashing Competition winner) for key derivation, deliberately increasing computation time (at least 500ms on modern hardware) to resist brute force attacks. Second, it even encrypts public key (xpub) data - this seemingly excessive security measure is actually an important component of the "plausible deniability" strategy.

Sparrow's interface design reflects its core philosophy: supporting advanced features while maintaining intuitive usability.

From multisignature to watch-only wallets, from single private keys to complete HD wallets, all these complex concepts

are integrated into a unified interface.

Compared to other wallet software, Sparrow has two notable security features: First, it uses Argon2 (the 2015 Password Hashing Competition winner) for key derivation, deliberately increasing computation time (at least 500ms on modern hardware) to resist brute force attacks. Second, it even encrypts public key (xpub) data - this seemingly excessive security measure is actually an important component of the "plausible deniability" strategy.

In terms of functionality, Sparrow supports almost all mainstream hardware wallets, including Ledger, Trezor, Coldcard, and others. This broad compatibility isn't just simple aggregation, but provides a consistent user experience through a unified interface. Regardless of which hardware wallet users choose, they can achieve advanced wallet management functions through Sparrow.

For multisignature (MultiSig) wallets, Sparrow provides complete creation and management support. Users can mix different hardware wallets, providing not only manufacturer diversity protection but also flexible security strategy adjustment based on specific needs. For example, you can use Ledger to manage daily-use keys while using Coldcard to store backup keys.

More importantly, Sparrow supports complete descriptor wallets, meaning users can precisely control every technical detail of their wallet. This flexibility is crucial for implementing complex security strategies, such as creating sub-wallets for different purposes or implementing advanced inheritance planning.

What is a "Hardware Wallet": A Common Misconception

Before discussing hardware wallets, we first need to correct a common misconception. Many people view hardware wallets as devices for storing Bitcoin, similar to how traditional wallets store cash. This understanding is completely incorrect. From a technical perspective, what we call a "hardware wallet" is actually two completely different functional components: a signing computation device and a transaction broadcasting device.

The BIP44 specification defines the hierarchical deterministic path for HD wallets: m/purpose'/coin'/account'/change/address_index. However, some hardware wallet manufacturers have adopted their own derivation paths, such as Ledger using m/44'/60'/0'/0/0 for Ethereum, while Trezor strictly follows the BIP44 standard. While this difference might seem confusing, since all paths are open standards, any BIP39-compatible wallet can recover funds by adjusting the derivation path. For example, in Sparrow wallet, you can manually select different derivation paths to match specific hardware wallets. Using standard hardware wallets, assets can be recovered directly through the mnemonic words. Though different hardware wallets may use slightly different address derivation paths, these are all documented standard specifications, and through correct path settings, you can ultimately fully recover your assets.

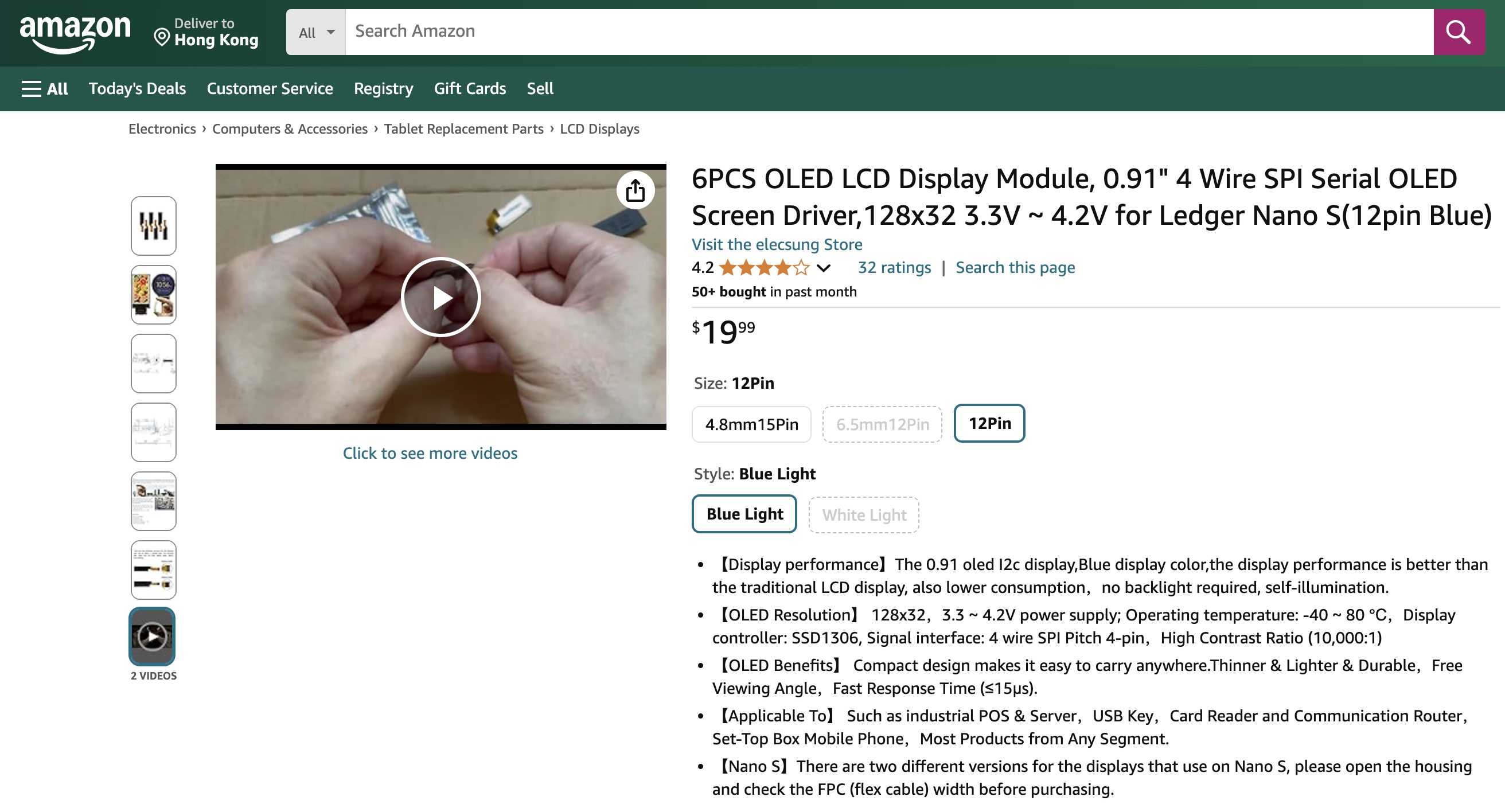

The complexity of electronic devices directly affects their lifespan and maintainability. Even relatively simple Ledger devices will encounter various hardware issues after 10 years of use, such as LED screen failure. However, compared to smartphones, these issues can usually be resolved through simple component replacement. This is exactly why we need hardware design to be as simple as possible. When choosing a signing device, many people ask: why not just use an old iPhone? On the surface, an offline iPhone seems like an ideal choice: it has good security, a complete operating system, and an excellent user interface. However, this choice ignores a key issue: the complexity of electronic devices is inversely proportional to their maintainability.

An iPhone contains thousands of components, each of which could become a potential point of failure. When devices experience problems after 5-10 years, the difficulty and cost of repairs might make the entire solution unfeasible. In contrast, specialized signing devices (like Ledger or ColdCard) adopt a minimalist design: one security chip, a simple processor, basic display screen, and buttons. This simplicity not only improves reliability but more importantly ensures long-term maintainability.

This design philosophy tells us: when choosing a Bitcoin storage solution, we shouldn't be misled by current convenience. We don't need the most powerful device, but rather simple and reliable tools that can continue working steadily for over 20 years. In this sense, the design philosophy of hardware wallets is very similar to Bitcoin itself: simplicity is the most important feature.

The Ledger Nano S LCD screen replacement kit is publicly available on Amazon,

complete with detailed repair video guides. This community-driven repair culture reflects Bitcoin users' pursuit of autonomy:

even for device repairs, they prefer to handle hardware wallets themselves rather than sending them to third parties.

This is where the value of simple hardware design lies - it allows ordinary users to perform basic maintenance.

The simplicity of hardware wallets reveals unique advantages in long-term use. Taking the Ledger Nano S as an example, when its LCD screen fails after years of use, users can completely repair it themselves. Considering the security properties of hardware wallets, sending devices back to manufacturers for repair could pose security risks, making self-repair the best choice. This repairability isn't accidental but stems from its modular and simple hardware design philosophy.

The Ledger Nano S LCD screen replacement kit is publicly available on Amazon,

complete with detailed repair video guides. This community-driven repair culture reflects Bitcoin users' pursuit of autonomy:

even for device repairs, they prefer to handle hardware wallets themselves rather than sending them to third parties.

This is where the value of simple hardware design lies - it allows ordinary users to perform basic maintenance.

The simplicity of hardware wallets reveals unique advantages in long-term use. Taking the Ledger Nano S as an example, when its LCD screen fails after years of use, users can completely repair it themselves. Considering the security properties of hardware wallets, sending devices back to manufacturers for repair could pose security risks, making self-repair the best choice. This repairability isn't accidental but stems from its modular and simple hardware design philosophy.

The Geopolitical Dilemma of Hardware Encryption

Those who would give up essential Liberty, to purchase a little temporary Safety, deserve neither Liberty nor Safety.

When discussing hardware wallet security, we face a rarely discussed but extremely important issue: all commercial hardware security modules (HSMs) actually come from very few countries. This is not coincidental. High-grade encryption technology has long been considered military equipment and is subject to strict export controls.

Currently, the security chips used in mainstream hardware wallets primarily come from these sources: ST31/33 series from France (used in Ledger), various commercial HSMs from the United States, and some NXP chips from the Netherlands. This highly concentrated supply landscape reflects not just technical barriers but also geopolitical realities. In today's consumer hardware wallet market, we mainly see encryption solutions from France (such as ST series chips used in Ledger) and the United States. While countries like Russia and China also have strong cryptographic research traditions and capabilities, their high-grade encryption technology is largely restricted to military applications and rarely seen in commercial products. This monopolistic market structure brings an unavoidable security concern: we must trust these mainstream encryption solution providers.

This creates a dilemma: completely open-source hardware solutions (like SeedSigner) are transparent and verifiable but cannot provide hardware-level key encryption protection; while solutions with encryption chips (like Ledger or Trezor) provide better physical security but inevitably introduce trust dependence on specific countries or companies.

More worryingly, these commercial encryption chips may all contain "backdoors." History has confirmed multiple times that some seemingly secure encryption solutions actually contained intentionally designed weaknesses. The famous RSA BSAFE incident is one example, where the NSA achieved decryption capabilities by planting backdoors in the standard.

This reality teaches us: when choosing and using hardware wallets, we can't blindly pursue any single feature. Both completely open-source solutions lacking hardware encryption protection and closed solutions providing hardware-level security have their limitations. True security often comes from a clear understanding of these limitations and using multiple protection mechanisms (such as passphrases) to compensate for the shortcomings of any single solution.

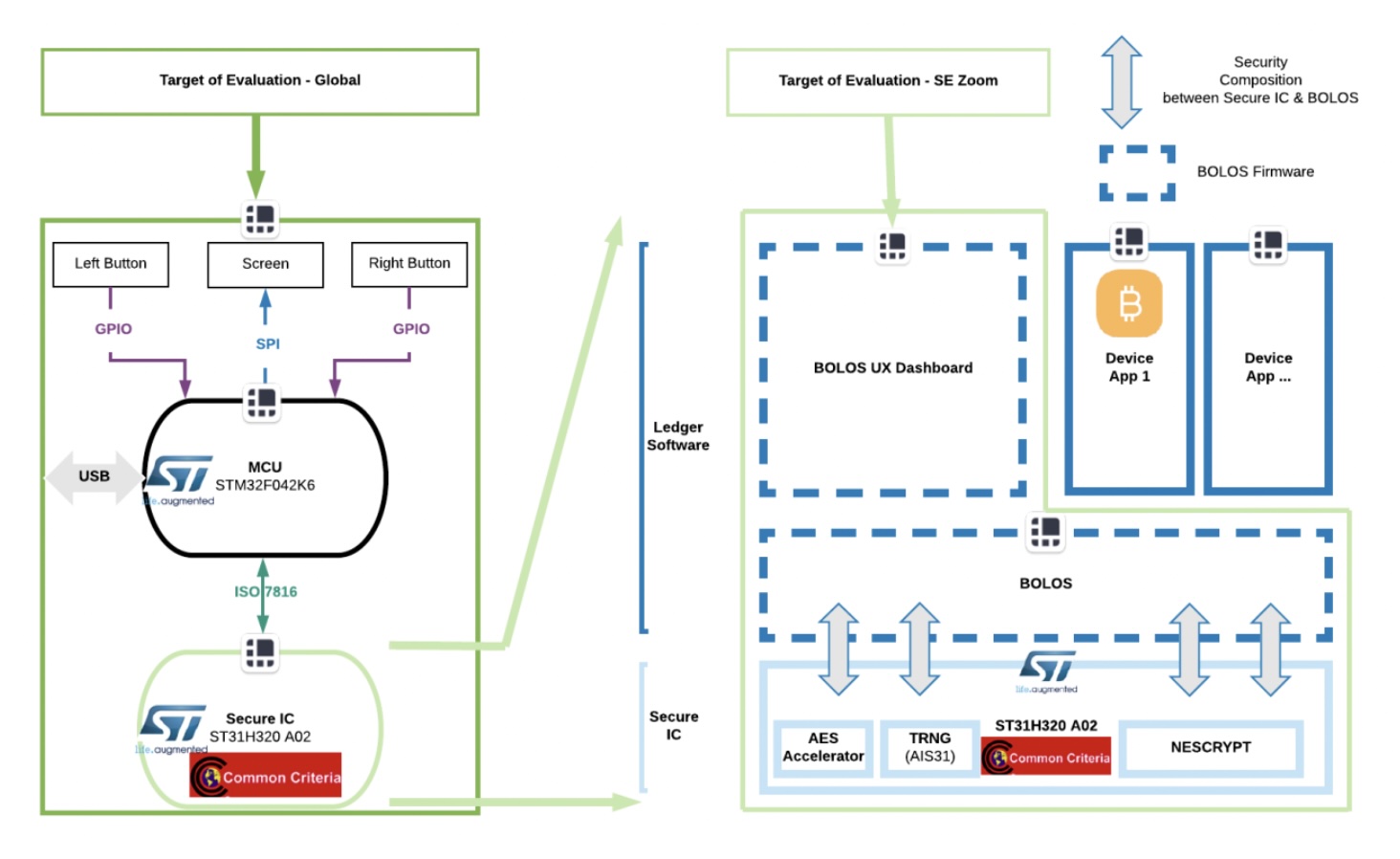

Ledger's dual-chip design: regular MCU (STM32F042K6) handles user interface and communication, while the security chip

(ST31H320 A02) processes all key-related operations. This isolation design communicates through the ISO7816 protocol,

ensuring keys never leave the security chip. The security chip has achieved Common Criteria EAL5+ certification from

France's National Cybersecurity Agency (ANSSI). In this diagram, pay special attention to the upper left section,

where each button represents an independent attack point.

Professional hardware security evaluation follows strict international standards. Taking France's CSPN (Security Certification of First Level) as an example,

this standard set by the French National Cybersecurity Agency

details every aspect of hardware security evaluation: from cryptographic algorithm implementation, random number generation,

to physical attack protection, all have rigorous testing requirements. This evaluation isn't one-time but an ongoing process,

ensuring devices maintain security throughout their entire lifecycle.

Ledger's dual-chip design: regular MCU (STM32F042K6) handles user interface and communication, while the security chip

(ST31H320 A02) processes all key-related operations. This isolation design communicates through the ISO7816 protocol,

ensuring keys never leave the security chip. The security chip has achieved Common Criteria EAL5+ certification from

France's National Cybersecurity Agency (ANSSI). In this diagram, pay special attention to the upper left section,

where each button represents an independent attack point.

Professional hardware security evaluation follows strict international standards. Taking France's CSPN (Security Certification of First Level) as an example,

this standard set by the French National Cybersecurity Agency

details every aspect of hardware security evaluation: from cryptographic algorithm implementation, random number generation,

to physical attack protection, all have rigorous testing requirements. This evaluation isn't one-time but an ongoing process,

ensuring devices maintain security throughout their entire lifecycle.

In Ledger's design, we can see several key features of professional encryption hardware: first is the physical isolation of security domains, completely separating regular operations and key operations through a dual-chip design; second is certified encryption algorithm accelerators (AES) and true random number generators (TRNG); finally, protection against physical attacks, including voltage fluctuation detection and temperature monitoring. These features cannot be achieved through simple software implementation but require specialized hardware design and manufacturing processes.

However, these certifications also create an interesting paradox: to pass security certification, chip manufacturers must disclose complete design details to evaluation agencies. This means that every certified security chip's internal implementation is fully known to at least one government agency. This brings us back to our earlier discussion of geopolitical issues: in pursuing hardware security, we must accept trust in specific institutions.

Hardware Wallet Choices and Trade-offs: Key Storage

Perfection is achieved, not when there is nothing more to add, but when there is nothing left to take away.

Currently, there are several well-known hardware wallet brands in the market, each with distinct chip choices:

- Coldcard: Uses ATECC608A security chip, a FIPS-certified encryption chip from Microchip

- Trezor: Evolved from early designs without encryption chips to the current Model T with integrated ST31H320 security chip

- OneKey: Earlier models followed Ledger’s ST31 series, but the new OneKey Pro ships with the world’s first EAL 6+‑certified secure element (Infineon SLE78‑class), raising the bar for consumer hardware‑wallet chips

Common Criteria EAL levels reflect the depth and rigour

of third‑party testing. EAL 5+ (Ledger ST31) is already considered “Semi‑Formally Designed and Tested”,

while EAL 6+ adds “Verified Design and Tested”, demanding systematic vulnerability analysis and formal verification of critical modules.

In practice, moving from 5+ to 6+ mainly increases assurance against sophisticated side‑channel and fault‑injection attacks,

but does not eliminate the geopolitical and supply‑chain trust questions we discussed earlier.

Why this matters: OneKey’s move to an EAL 6+ chip narrows the physical‑attack gap with What are “dedicated smart‑card solutions”?

Industry shorthand for standalone, tamper‑resistant Secure Element / JavaCard devices—e.g. Infineon SLE78, NXP P5—used in EMV bank cards, national e‑ID chips, and electronic passports.

They feature epoxy potting, power/clock/light sensors, and a crypto co‑processor, communicating via ISO 7816 or NFC.

IBM mainframe 4767/4769 PCIe HSMs, sometimes cited in high‑security contexts, are datacentre hardware security modules, not pocket‑size smart‑cards—target and threat model are entirely different.dedicated smart‑card solutions,

yet users must remember that certification focuses on implementation correctness; it cannot prove that a chip is

completely back‑door‑free. Country‑of‑origin, secure boot policies, and update mechanisms remain critical factors

when choosing any hardware wallet.

Hardware Wallet Chip Comparison: 1. Coldcard: ATECC608A (Microchip) 2. Trezor Model T: ST31H320 3. Ledger Nano S: ST31H320 4. OneKey: ST31 series Each choice reflects the manufacturer's balance between security and usability. Among these choices, the non-Bluetooth, battery-free versions of Ledger Nano S/Plus are particularly recommended for the following reasons:

First, regarding maintenance difficulty, electronic device reliability is inversely proportional to its complexity. Lithium battery lifespan is usually the biggest weakness of hardware wallets, typically showing performance degradation after 2-3 years. Battery replacement not only increases maintenance costs but may also affect device water resistance.

Second, while Bluetooth technology is convenient, it has inherent security vulnerabilities that are difficult to completely resolve. Even the latest Bluetooth 5.0 protocol still faces threats such as man-in-the-middle attacks and replay attacks. The 2019 KNOB (Key Negotiation Of Bluetooth) vulnerability proved that even the most basic Bluetooth pairing mechanism could have serious flaws.

In comparison, USB communication, though seemingly "outdated," actually provides a more controllable communication channel. The USB protocol is completely open, and its security has been verified over decades. Of course, USB communication isn't completely risk-free, which is why we'll specifically discuss USB security details later.

Therefore, in hardware wallet selection, we should follow the principle that "simplicity is ultimate sophistication." The non-Bluetooth, battery-free design of Ledger Nano S/Plus achieves higher reliability and security by reducing potential failure points and attack surfaces. This design philosophy aligns perfectly with Bitcoin's own philosophy: for critical financial infrastructure, simplicity and reliability should take priority over convenience.

To better understand how Ledger's browser extension wallet works and its usage process, here's a basic video demonstration:

This video demonstrates Ledger's connection with Metamask. Through watching, you can clearly see how this hardware solution implements wallet (public key) import, and how its simple yet elegant design ensures private key security. Most importantly, the video shows how to use device signing to achieve completely offline transaction signing.

Ledger Live provides an intuitive asset management interface, supporting various cryptocurrencies including:

1. Bitcoin

2. Ethereum

3. Stablecoins

4. Various DeFi tokens

The clean interface design makes it easy even for cryptocurrency newcomers to manage their asset portfolio.

Another significant advantage of the Ledger ecosystem lies in its seamless user experience. Modern cryptocurrency investors often need to interact with different Web3 applications, and Ledger provides extensive browser plugin wallet support through its WebUSB interface. Users can directly use hardware wallet signing in mainstream browser plugins like Metamask and Phantom. This level of integration far surpasses its main competitor Trezor.

Ledger Live provides an intuitive asset management interface, supporting various cryptocurrencies including:

1. Bitcoin

2. Ethereum

3. Stablecoins

4. Various DeFi tokens

The clean interface design makes it easy even for cryptocurrency newcomers to manage their asset portfolio.

Another significant advantage of the Ledger ecosystem lies in its seamless user experience. Modern cryptocurrency investors often need to interact with different Web3 applications, and Ledger provides extensive browser plugin wallet support through its WebUSB interface. Users can directly use hardware wallet signing in mainstream browser plugins like Metamask and Phantom. This level of integration far surpasses its main competitor Trezor.

Providing such a user-friendly experience while maintaining security is one of the key reasons why Ledger has maintained its leading position in the hardware wallet market. Whether viewing asset changes through Ledger Live or interacting with DeFi applications, users can enjoy a smooth and secure experience. This usability makes it an ideal bridge connecting traditional financial users with the cryptocurrency world.

However, it's worth noting that this convenience needs to be understood within the security framework. For large Bitcoin savings, we still recommend using completely offline methods, keeping daily transaction funds completely separated from long-term savings. Ledger's passphrase functionality provides ideal technical support for this separation.

Ledger Live as Ledger hardware wallet's companion software supports over 1,500 cryptocurrencies. Even with offline Nano S/Plus, you can monitor your assets by importing watch-only wallets. This design ensures private key security without compromising asset visibility. While this article primarily focuses on long-term Bitcoin savings, we must also acknowledge a reality: during bull markets, many people will want to increase their Bitcoin holdings by trading other cryptocurrencies (altcoins). In this scenario, Ledger's comprehensive ecosystem shows unique advantages.

Compared to hardware wallets focused solely on Bitcoin like Coldcard or Seed Signer, Ledger has built the most complete altcoin support ecosystem through its long history. This broad support isn't simple feature stacking but is based on the same security architecture: private keys for each currency are protected by the security chip, while supporting watch-only wallet functionality.

This design allows users to implement "coin-based" investment strategies without compromising security. For example, you can use altcoin trading to accumulate Bitcoin during bull markets while keeping your main Bitcoin savings completely offline. Ledger Live's watch-only wallet functionality makes executing this strategy simple and secure.

However, this convenience also brings additional complexity. Users need to clearly understand that: the more supported coins, the larger the software's attack surface. This is why we recommend separating large Bitcoin savings from daily trading cryptocurrencies, which can be achieved using different passphrases.

DeFi Risks: Learning from History

The December 2023 Ledger Connect Kit incident reminds us that even the most secure hardware wallets can face risks when interacting with the DeFi ecosystem. Attackers hijacked an npm package, causing approximately $600,000 in losses within just 5 hours. This incident proves the necessity of completely separating Bitcoin savings from DeFi interactions. While Ledger provides excellent multi-coin support, we must clearly recognize that any interaction with the DeFi ecosystem brings additional risks. These risks don't come from the hardware wallet itself, but from the complex DeFi ecosystem and various integration interfaces.

Taking the December 2023 Ledger Connect Kit incident as an example, attackers planted malicious code by hijacking a former employee's npm account. This incident affected multiple prominent DeFi projects, including:

- SushiSwap

- Phantom

- Balancer

- Other major platforms

Although the Ledger team deployed a fix within 40 minutes, it still resulted in losses of approximately $600,000.

This incident teaches us several key lessons:

- Long-term Bitcoin savings must be completely isolated from DeFi interactions

- Use different passphrases to separate wallets for different purposes

- Only use dedicated small-amount trading wallets for DeFi operations

This is exactly why we consistently emphasize: although Ledger provides convenient multi-coin support, main Bitcoin savings should be kept completely offline, avoiding any association with online services or DeFi protocols. Convenience and security often conflict, and when dealing with important assets, we must prioritize security.

Stateless Signing Devices: Returning to Bitcoin's Essence

Those who would give up essential Liberty, to purchase a little temporary Safety, deserve neither Liberty nor Safety.

Before understanding Seed Signer and other stateless devices, we need to rethink a fundamental question: do Bitcoin private keys really need to be "stored"? In fact, each transaction only needs to temporarily rebuild the private key at signing time, destroying it immediately after completion. This profound realization has led to a completely new hardware wallet design philosophy.

Seed Signer's design is extremely simple: a Raspberry Pi Zero board, a display screen, and a camera.

This simplicity makes it a truly verifiable open-source hardware solution. Users input seed information

through hand-drawn QR codes, the device only temporarily rebuilds private keys during signing,

immediately clearing all sensitive data from memory afterward. This minimalist design ensures

users can fully control and verify every hardware component, achieving true air gap isolation.

Seed Signer embodies this design philosophy from its name to its implementation. It consists of two core parts: a hand-drawn QR code system for information input, and a simple computing device for signing. This design not only minimizes the attack surface but perfectly implements air gap (physical isolation).

Seed Signer's design is extremely simple: a Raspberry Pi Zero board, a display screen, and a camera.

This simplicity makes it a truly verifiable open-source hardware solution. Users input seed information

through hand-drawn QR codes, the device only temporarily rebuilds private keys during signing,

immediately clearing all sensitive data from memory afterward. This minimalist design ensures

users can fully control and verify every hardware component, achieving true air gap isolation.

Seed Signer embodies this design philosophy from its name to its implementation. It consists of two core parts: a hand-drawn QR code system for information input, and a simple computing device for signing. This design not only minimizes the attack surface but perfectly implements air gap (physical isolation).

The most striking feature of this design is that it stores absolutely no private keys or seed information. Each time it's used, users need to input seed information by scanning hand-drawn QR codes. This seemingly "inconvenient" design is actually an extreme security consideration: if the device itself stores no sensitive information, it cannot possibly leak such information.

The communication solution equally reflects minimalism: the camera is used to read transaction information and seed information, while the display screen shows transaction details to be signed and the final signature results. This one-way physical communication method fundamentally eliminates the possibility of remote attacks. More importantly, this design makes the entire device's behavior completely predictable and verifiable.

This design philosophy represents an important development direction for Bitcoin hardware solutions: rather than adding more security features to protect keys, it completely eliminates persistent key storage to avoid risks. While this solution sacrifices some convenience in usage, it provides a truly verifiable choice for users pursuing ultimate security.

This Bitcoin Magazine comprehensive guide covers the complete process from hardware procurement and assembly to specific usage. While the article is lengthy, considering it concerns your wealth security, it's worth taking time to read carefully. The article also demonstrates the advantages of open-source hardware solutions: every detail is transparent and verifiable. If you've read this far, you likely understand the core principles of secure Bitcoin private key storage. And Seed Signer, as a completely open-source signing device, perfectly embodies these principles. If your goal is long-term Bitcoin holding, I strongly recommend spending a few hours carefully reading and considering the above guide before taking action. Investing time in learning and understanding is much wiser than blindly pursuing quick action. After all, in the cryptocurrency world, ignorance is often more dangerous than carelessness.

To better understand SeedSigner's working principles and usage process, here's a basic video demonstration:

This video demonstrates SeedSigner's complete build and usage process. Through watching, you can clearly see how this open-source hardware solution achieves true air gap isolation, and how its simple yet elegant design ensures private key security. Most importantly, the video shows how to achieve completely offline transaction signing through hand-drawn QR codes.

About Multisignature and Key Sharding: A Sober Perspective

Complexity is the worst enemy of security.

In February 2025, the crypto exchange Bybit suffered the largest Ethereum theft in history—hackers stole approximately 401,000 ETH, valued at around $1.5 billion at the time.

The hackers didn't use sophisticated methods; they simply exploited the "upgrade permission" in the smart contract—modifying the owner address to take control of the funds. The vulnerability lay in the Safe{Wallet} infrastructure they relied on. Attackers injected malicious JavaScript to manipulate transaction signing conditions, disguising the fund transfer as a normal operation.

The so-called "upgrade capability" sounds flexible but is actually a security disaster. Multisig should be secure, but as long as the contract allows dynamic owner changes, it's like having a door lock that can be hot-swapped—having multiple locks is useless.

In stark contrast is Bitcoin's multisig structure: all signers and rules are fixed at address creation, making any subsequent modification impossible. Bitcoin's P2SH multisig is inherently non-upgradable, doesn't rely on program logic, and avoids the embarrassment of "code is law, code is flaw."

Related English news report: Business Insider

Summary: Multisig ≠ More Secure. In personal Bitcoin savings scenarios, whether it's multi-party multisig or single-person controlled pseudo-multisig, there are unavoidable game-theoretic risks and operational pitfalls. We start from game theory to clarify the human dilemmas and structural fallacies involved.

I. Multi-Party Multisig: Human Weakness is Always the Security Bottleneck

In a multi-party 2-of-3 multisig structure, theoretically, two signers must reach consensus to move funds. This is intended to prevent single points of failure and enhance fault tolerance. But game theory tells us that whenever multiple parties hold power, the "minimum collusion threshold" problem always exists—an attacker only needs to persuade two people to bypass any defense.

A more realistic risk is that the third person might be bribed, coerced, or betray due to deteriorating relationships. Once human variables come into play, technical protections become meaningless. This structure doesn't eliminate trust; it redirects trust from devices to people. We call this "false security through trust redirection."

FBI research indicates that social engineering attackers often identify the most easily swayed key holders through social network mapping. Even with geographical distribution, once the social network is exposed, attack paths can form. See: FBI Social Network Investigation Handbook. In actual attacks, social relationships often constitute the biggest leakage point for key systems. Bribery, relationship infiltration, and family coercion are common incentives for collusion. Therefore, as long as multisig relies on "multiple humans," the human attack surface cannot be avoided.

II. Single-Person Multisig: Complicated Single Point of Failure

Some users, driven by the psychology of "it looks more secure," adopt a 2-of-3 scheme where they hold all the keys themselves. This "pseudo-multisig" structure is formally decentralized but substantively remains single-point control. If an attacker can gain access to all your devices, backups, or access points, the attack outcome is no different from cracking a single signature.

Both the FBI and CISA point out that attackers often gain control of a victim's phone through SIM swapping or social engineering phishing, then use their email and cloud backups to recover other critical access points. See: CISA Guide. Many might argue: "You can't get all my devices and backups." But the reality is, attackers often only need to breach one device or one cloud service account to get "everything." FBI and CISA cases show that most attackers prioritize targeting the phone. By controlling SMS via SIM swapping, they can reset email passwords, take over cloud storage, read password managers, and consequently gain chain control over all assets. Even if a user uses multiple devices, if they sync automatically, use the same cloud account, or browser password sync, these "independent" backups actually lie on the same logical attack surface. In other words, attackers don't need to physically touch every backup; capturing your commonly used device or account allows them to "aggregate" all your keys.

Academic research shows that individual users struggle to maintain physical isolation of multiple keys. Whether it's multisig, multi-location backups, or mixed storage media, they eventually "aggregate" operationally due to convenience, human error, or information leakage. An operational security (OPSEC) study revealed that even trained ordinary people find it difficult to implement true physical key isolation. See: MILCOM OPSEC Experiment Report. From an academic perspective, individual users attempting true key isolation often face five dilemmas:

- Structural conflict between convenience and security: To avoid daily usage hassles, most people reconsolidate originally dispersed keys;

- Limited geographical and social resources: Storing backups with relatives/friends or in bank vaults introduces trust issues or operational delays;

- Human single point of failure: If one person knows all key locations, attackers can trace them through social engineering or phishing;

- System complexity leads to operational errors: Managing multiple devices, backups, and tools increases the chance of confusion or forgetting;

- Attackers have economic asymmetry advantage: Users must protect all entry points, while attackers only need to breach the weakest link, like email or a commonly used phone.

These five factors intertwine, forming a complex game structure. Attackers only need to find one weak link to breach the entire system's defenses. Users, on the other hand, must remain vigilant on multiple levels to ensure asset security.

Therefore, the "redundancy" design of single-person multisig doesn't truly enhance security; instead, its complexity might increase the risk of operational errors. Attackers only need to breach one link to obtain all keys. If three keys exist in the same country, same home network, or same physical space, from a game theory perspective, these are not 3 independent control points but a single point of failure system with complex packaging. You might think you've added "redundancy," but you've actually just raised the usage barrier without increasing the attack cost.

The security best practice consensus holds that individuals cannot achieve the same level of key isolation as institutions. The most common alternative strategies include entrusting a trusted third party with some keys or using professional multisig custody services. For those insisting on complete self-custody, one must accept the fact that "absolute isolation is a theoretical ideal, not a practical reality."

And the problems with custody, as previously discussed, are not "Bitcoin-level secure" enough.

In comparison, adopting a compartmentalization strategy (e.g., using different wallets, different mnemonic phrases, different passphrases to manage assets) is better, allowing attackers to access only a portion of the funds at most. This "worst-case loss limitation" design is the truly rational structure from a game theory perspective.

Conclusion: Don't be misled by "technical complexity." True security comes from structural simplicity and a closed control surface. For individual Bitcoin holders, mastering simple structures and understanding risk boundaries is the best way to defend against human weaknesses and real-world attacks.

Game Theory Addendum for Single-Person Multisig: Shifting the Game Model for Survival

For friends who, after understanding the complexities and potential risks of single-person multisig, still decide to use it as their ultimate asset storage solution, I implore you to further consider the following points from a game theory perspective. This might, in extreme circumstances, offer you a lifeline.

The Inherent Risk of Multisig: The Threshold of Information Leakage

A traditional 2-of-3 multisig structure bases its security model on the distributed custody of keys. However, this also directly implies that once an attacker gains control of 2/3 of the critical information (e.g., two private keys or their backups), your assets face a 100% risk of theft. In a scenario where a single person holds all keys of a multisig setup, this risk is not diminished by the term "multisig"; instead, it might be amplified by the complexity of management.

An Alternative Approach: Dual-Layer Passphrase and Probabilistic Defense

Compared to managing multiple separate, complete private keys (such as the three keys in a 2-of-3 multisig), we can leverage the characteristics of BIP39 passphrases to design a "dual-layer passphrase defense" strategy, which might be superior in terms of memory burden. The core idea is: under the extreme assumption that the seed words have already been compromised (e.g., obtained through a physical search), your asset security further relies on two independent passphrases, let's call them Passphrase X and Passphrase Y.

- Using Passphrase X: Combined with the seed words, it generates Wallet X, holding, for example, 10% of your total assets (can serve as a first-layer sentinel or honeypot).

- Using Passphrase Y: Combined with the seed words, it generates Wallet Y, also holding, for example, 10% of your total assets (can serve as a second-layer sentinel or honeypot).

- Using Passphrase Z (e.g., formed by concatenating X and Y in a specific way like X+Y, or a more complex, unique phrase derivable only from X and Y): Combined with the seed words, it generates Wallet Z, holding the remaining 80% of your core assets.

Under this design:

- If an attacker coerces you into revealing Passphrase X, they only gain 10% of the assets.

- If further coerced into revealing Passphrase Y, they gain another 10%. At this point, you've lost a total of 20%.

- Access to the core assets (Wallet Z) depends on Passphrase Z. Even if the attacker obtains X and Y, they may not be able to directly deduce Z (unless the method of constructing Z is revealed by you or is overly simplistic). This leaves room for game play and might mean you only need to firmly remember two basic segments (X and Y) and their combination method (Z), rather than three entirely unrelated keys.

The advantages of this strategy include:

- Graduated Loss: Partial compromise does not equal total loss, providing a buffer against coercion.

- Honeypots/Sentinels: Wallets controlled by Passphrase X and Y can act as early warning signals or serve to mislead attackers into believing they have succeeded, thereby lowering their guard.

- Bargaining Space: The attacker cannot be certain if they have obtained all information or how to securely obtain the remainder, increasing their operational costs and uncertainty.

- Potential Memory Advantage: Compared to memorizing three complete and independent sets of private key information (as for a 2-of-3 multisig), memorizing two core passphrase segments and their method of combination might be easier to manage and conceal.

Game Theory Under Physical Duress: Prolonging the Game to Increase Chances of Survival

Even if the above design does not fully convince you to adopt it, I implore you to remember this core idea: Through layered, multi-stage protection, compel the attacker to believe you still possess unrevealed "trump cards" or deeper secrets.

In extreme situations involving physical coercion (such as a "rubber-hose attack" or "$5 wrench attack"), if attackers, after breaking what appears to be your "final" defense (e.g., obtaining your multisig devices and completing a signature, or getting some passphrases), find they still haven't gained full control of all assets, they might re-evaluate your "utility value." They might reason that temporarily keeping you alive to potentially extract more information or remaining assets is preferable to immediately resorting to extreme measures like elimination, which would end the game entirely. A living person who might still hold "secrets" could be more valuable to them than a dead person confirmed to have nothing left.

Breaking the Prisoner's Dilemma: Transforming a Single-Shot Game into a Continuous One

This borrows from the core element of resolving the lose-lose outcome in a "Prisoner's Dilemma": strive to cleverly transform a one-time, potentially full-disclosure game into a seemingly sustainable, incomplete-information "eternal game." By doing so, you increase your probability of survival in a desperate situation. Your goal is to make the attacker believe that cooperating with you (i.e., not harming you immediately) will yield greater (or more certain) benefits than unilateral action (immediate elimination).

Of course, this is not a foolproof guarantee, but it offers a way of thinking to seize the initiative in despair. Please remember this point and, considering your own circumstances, deliberate carefully to design a strategy that not only secures your assets but also maximizes your chances of survival in the worst-case scenario.

Bitcoin Inheritance: Simplifying Estate Planning

In the digital age, the true measure of technology lies not merely in amplifying today’s efficiency, but in forging a lasting pathway of wealth and knowledge for generations to come. If we harness innovation only to accelerate the present without ensuring its inheritance, all we achieve may eventually slip into oblivion.

The most famous case involves early Bitcoin participant Mircea Popescu, who tragically drowned while swimming off a Costa Rican beach in June 2021. He reportedly controlled up to 1 million bitcoins, which may now be forever locked on the blockchain. Similarly, in June 2023, a group including individuals holding significant cryptocurrency assets perished during the "Titanic" deep-sea expedition. These tragic events remind us: death is often sudden, and without proper inheritance planning, vast digital wealth can vanish forever. All the technical solutions we've discussed must eventually confront a practical problem: how to ensure these digital assets can be passed on to the next generation? This question is vital because, unlike traditional assets, Bitcoin lacks centralized institutions to assist with inheritance. If private keys are lost, the assets become permanently locked on the blockchain. Bitcoin's history is replete with examples of vast fortunes lost forever due to accidents. These cases underscore that inheritance planning is not optional, but essential.

In the traditional financial system, inheritance is governed by comprehensive legal frameworks and execution mechanisms. In the Bitcoin world, however, if private keys cannot be transferred, even the most meticulously crafted will is useless. This is why our proposed solution must be simple enough to be reliably conveyed during life's final moments. Some might suggest complex multisignature schemes, but imagine: in that critical moment, could you clearly explain such intricate technical details? Against this backdrop, the simplicity of the passphrase we emphasized earlier becomes particularly crucial. An ideal passphrase should be:

- Easy to remember and convey

- Personally significant

- Clearly expressible in emergencies

In essence, the passphrase can become your "last will." While the mnemonic phrase might be passed down physically (e.g., hidden in a book), the passphrase can be transmitted verbally at the final moment. This very simplicity ensures that the wealth can be smoothly transferred during life's critical junctures.

This also serves as a reminder that when designing Bitcoin storage solutions, inheritability must be considered alongside security. Overly complex schemes might fail because they cannot be effectively transferred. Conversely, simple and elegant solutions are more likely to withstand the test of time. Much like the design of Bitcoin itself, true wisdom often lies in the ability to simplify complex problems.

Neuroscience research indicates that after severe concussions or trauma from accidents, the brain is most likely to forget recent memories, while long-term memories formed during childhood and adolescence remain the most stable.

Therefore, choosing an important memory from your adolescence as a passphrase not only makes it easier to remember long-term but also potentially makes it the information you are most likely to recall after a major accident.

Reference: Kandel, E. R., Schwartz, J. H., Jessell, T. M. et al. (2013). Principles of Neural Science (5th ed.). McGraw-Hill.

The book notes that short-term memory is more commonly impaired after concussions or traumatic events, while earlier episodic memories, such as those from adolescence, are more likely to be preserved.

This is also the human aspect of Bitcoin: letting you guard your wealth with the most cherished memories of your life. Bitcoin isn't just cold code; it respects human vulnerability and memory mechanisms, encouraging you to choose fragments etched in your youth as your digital key.

The Legacy of Digital Civilization: A Time Capsule from Bitcoin

Billions of people have lived throughout history, yet only a tiny fraction of names are recorded in history books. Some civilizations were even completely forgotten before being rediscovered by later archaeologists. For example, the Hittite civilization was once lost in the dust of ancient Middle Eastern history until the late 19th century when archaeologists discovered thousands of cuneiform tablets in Anatolia, reconfirming the existence of this powerful empire that once rivaled ancient Egypt. However, not a single individual name with lasting influence has survived in Hittite records.

If Bitcoin's ultimate form is a decentralized mechanism for safeguarding wealth and memory—then its inheritance structure, particularly the verbally transmitted passphrase design, might create an entirely new path for "digital archaeology."

Just as the password "Open Sesame" in the tale of Ali Baba and the Forty Thieves unlocked a hidden treasure, forgotten passphrases in the Bitcoin world might guide future "Bitcoin archaeologists" to reopen the digital legacy of anonymous individuals. Their reliance wouldn't be on brute force, but on rereading that person's life: their childhood, youth, hobbies, language habits, cultural background—these become the clues.

In Mexican culture, there's a saying: "A person is not truly dead as long as they are remembered in the hearts of others." Bitcoin's inheritance mechanism might offer a new ritual for this remembrance: when relatives seek to recover someone's passphrase, they are compelled to revisit the details of his life, re-experiencing his journey. This is a humanistic reflection prompted by technology, a form of digital mourning encased in cryptography, keyed by memory.

As the physical world eventually succumbs to thermodynamic entropy, Bitcoin's "memory as asset" inheritance method might become a gentle echo within the remnants of human civilization—not just a financial tool, but a cultural mechanism for commemorating individual lives and encouraging intergenerational continuity.

Conclusion

The devil is in the details.

As Mies van der Rohe noted, the devil truly is in the details. In the practice of Bitcoin security storage, many critical technical details require professional guidance:

Critical Technical Details:

- Hardware Wallet Import Details

- When recovering with Ledger, should you choose 12 or 24 words?

- Why does Ledger Live show "Import Successful" but zero balance?

- How to verify if the imported mnemonic is correct?

- Temporary Passphrase Management

- Should the temporary passphrase be stored in the device or re-entered each time?

- How to verify if the passphrase is correctly active?

- How to migrate passphrase settings when changing devices?

- Derivation Path Issues

- Why do identical mnemonics show different addresses in different wallets?

- What's the path difference between native segwit and nested segwit?

- How to ensure address consistency when switching wallet software?

- Transaction Broadcasting and Node Selection

- How to safely broadcast offline-signed transactions?

- What are the differences between Electrum nodes and full nodes?

- How to verify node reliability?

- Privacy implications of private vs. public nodes?

- Privacy Protection Strategy

- How to avoid address reuse?

- What is CoinJoin and how to use it safely?

- How to prevent transaction graph analysis?

- How to use PayJoin for privacy protection?

- UTXO Management and Transaction Fees

- How to effectively manage UTXOs to reduce future transaction costs?

- How to select optimal transaction fees?

- Security strategies for change addresses?

- How to handle dust attacks?

- Mobile Configuration

- Mobile solutions compatible with Sparrow

- How to ensure mobile wallet security?

- Safe interaction between cold and hot wallets?

- Watch-only Wallet Setup

- How to safely export/import public key information?

- How to synchronize multiple watch-only wallets?

- How to prevent privacy leaks from watch-only wallets?

- Emergency Preparation

- Contingency plans for hardware wallet failure

- How to prepare secure backup devices?

- Asset access strategies during international travel

Each of these details can impact your asset security. A seemingly simple misconfiguration could lead to:

- Inaccessible funds

- Unnecessary transaction fee waste

- Privacy breaches

- Security vulnerabilities

I offer the following professional consultation services:

- Customized security strategies based on your specific needs and risk profile

- Step-by-step guidance for hardware wallet setup and configuration

- Best practices for UTXO management and privacy protection

- Security strategies for node setup and transaction broadcasting

- Inheritance planning tailored to your family situation

- Review and audit of existing security setups

For professional consultation, please contact:

- Email: william.yang@trustlessenterprise.com

- Available for both remote and in-person consultations

- Customized solutions for individuals and organizations

- Strict confidentiality guaranteed

Remember: when it comes to securing significant Bitcoin holdings, the cost of professional guidance is minimal compared to the potential risks of improper setup. Your digital assets deserve the same level of professional care you would give to any other significant investment. In digital asset security, every detail matters. Professional guidance not only helps you avoid potential risks but also enables you to truly understand and control the security of your digital assets.